It is time to revisit six of the most common financial myths we have come to believe. Accepting any of these as a reflection of reality could lead us down the path to ruin. Unfortunately, belief in them is so widespread most people no longer even question them and are putting their economic future in peril. A

myth is often defined as any invented story, idea, concept, or false collective belief that is used to justify a social institution. With this in mind, it is understandable those in the government and financial systems would crank out such yarns to keep us docile.

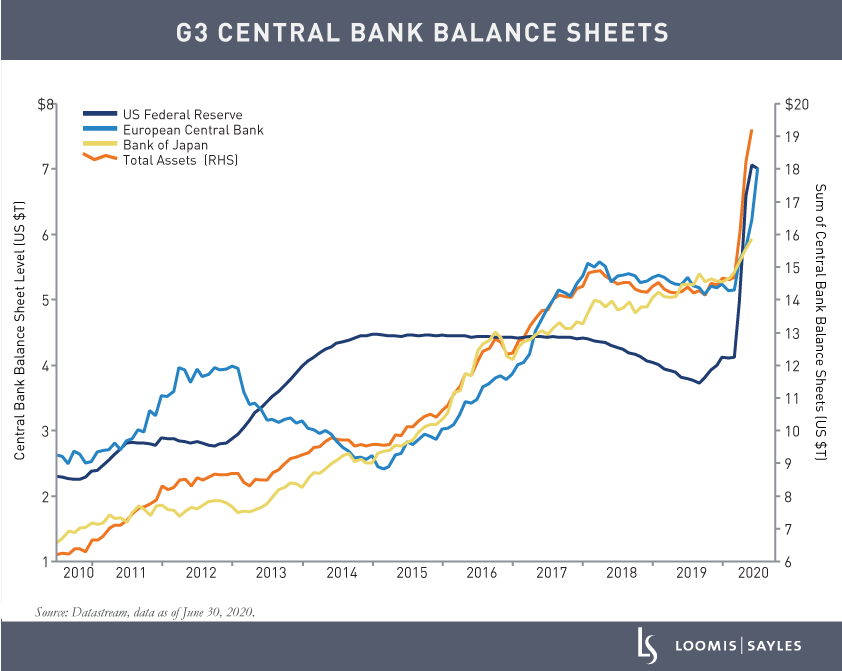

The six favorite financial myths are easier to believe when financial fears are low and times are good. Over the last few years, a slug of

freshly printed liquidity being pumped into the global financial system

and stock markets has caused many asset bubbles to

expand sending the wealth effect into overdrive. An increase in liquidity results in people feeling comfortable to take

on more risk and this tends to cause people to “leverage up.” During such a time true

price discovery has a way of being greatly diminished.

Changes made to the rules and financial engineering have made many comparisons to the past obsolete. Sometimes, it is a question of people just being too

lazy to question what they see, at other times, it is because they simply can’t face the truth. It should be noted that the entertainment industry has flourished as society seeks any

diversion to pull our attention away from the sharp edges of reality and

into the soft comfort of escape. In some ways, it could be said that our culture has become obsessed with avoiding what is real. Regardless of the reason why people fail to view the myths below as lies the point is they will result in the financial ruin of those counting on them in time of need.

Over the years, extraordinary efforts have been made to keep the economy afloat. The most noticeable is the massive amount of new money and credit released into the financial system by central banks. This has been interpreted by many people as confirmation the current trend of never-ending growth will continue. Rather

than considering it is time for a reality check it is both easier and

more comforting to adopt an “all is well” attitude and ignore the signs

of danger lurking around the corner.

The

crux of this article is about some of society’s favorite myths. These

feed directly into the economy and our feelings about our financial

security. While it could be argued the myths below have more to do with how we

feel about life than about money, it cannot be denied that most people make many of their

financial decisions based on the assumption the below statements are

true. As a society, we rapidly choose to embrace and often choose not to

question them because of the discomfort it would undoubtedly create.

The six below permeate society and should be enough to remind you

and even shed a bit of light upon the fact we as individuals are vulnerable at any time

if reality raises its’ ugly head.

|

| Believing Myths Is A Head In Sand Approach |

#1 Government is for the people and by the people – Seriously? After

the dog and pony show we experienced during the

last presidential

primary all illusions of that should have been erased. After often being

forced to choose between the least of two evils it is difficult to

praise our political system. After all the talk about “we the

people,” the fact is the average “person” is far removed from the power

to decide important issues.

#2 Financial planning means you only have to start saving a little money each year to guarantee an easy retirement.

– The fact is life is a casino where our future is tenuous at best.

Much of our circumstances and lives revolve around money and the number

of options it gives us when we possess it. I intentionally used the term

“casino” to conjure up the image of financial fortune. Which you can

lose in a blink of an eye if things go against you. This myth extends deeply into the promises made by the government and others such as

pension plans and financial institutions. Many of these promises will not be honored.

#3 You have rights and that we are not slaves – I defer to a few

lines from a blog by Gerry Spence who has spent his lifetime

representing and protecting victims of the legal system from what he

calls The New Slave Master: big corporations and big government. In his

blog, Spence wrote; The Moneyed Master has closed its doors against

the people and sits on its money like an old hen on rotten eggs. The

people will not prevail. With its endless propaganda, the Moneyed Master has caused its slaves to believe they are free.

#4 Your life will progress and move along pretty much as you have planned

– When you think back over the years of your life if you are like most

people things have not unfolded as you had planned. You may not be in

the occupation you trained for or with your true love. Throughout our

life watershed events occur that we have little control over, this holds

true when it comes to your finances as well. Having an investment or pension plan go south can completely alter your life.

#5 Those in charge or above you care about you and will make an effort to protect you

– Sadly, more than one person has been sliced and

diced by the people and institutions he or she trusted most. History shows when push

comes to shove it is not uncommon for a person to look out for the

person they treasure the most and that is often him or herself.

Politicians and those in power have a long history of throwing the populace under the bus rather

than taking responsibility for the problems they create.

#6 It could be argued the biggest myth of all is the idea that inflation is reflected

in the Consumer Price Index. Those making financial decisions have masked their failings. This is done by heavily skewing the CPI to give the impression there is little inflation. This dovetails with a theory I continue to expound on, that inflation would be much higher if people were not willing to invest in intangible assets such as stocks and Bitcoin. This removes a lot of demand for tangible items people use in their everyday life.

The fact is inflation is soaring and acts as a wealth transfer mechanism that hurts far more people than it helps. My apologies if this post has been a downer or seems overly negative,

however, it is what it is and it was written for a reason. Best stated

by a comment I read on another site; These myths add up to where “This

is not a can of worms but a warehouse stacked with pallets of cans of

worms.”

Believing the above myths will impact your life, that is why it is important to recognize them for what they are, lies. This is not to say that by making good and reasonable choices we

cannot eliminate some of the risks

we encounter when we get out of bed each morning. Developing the

habit of being skeptical while pressing on to reach solid and reasonable goals

is the best medicine to combat a deck that is often stacked against us.

Be careful out there!

https://brucewilds.blogspot.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Join: 👉 https://t.me/acnewspatriots

The opinions expressed by contributors and/or content partners are their own and do not necessarily reflect the views of AC.NEWS

Disclaimer: This article may contain statements that reflect the opinion of the author. The contents of this article are of sole responsibility of the author(s). AC.News will not be responsible for any inaccurate or incorrect statement in this article www.ac.news websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner. Reprinting this article: Non-commercial use OK. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

![Tucker Carlson Released an ALARMING Message … [Published Yesterday]](https://ac.news/wp-content/uploads/2024/04/download-3-120x86.jpg)

Discussion about this post