USA: Last week, some on Wall Street were quietly gloating when the “Lehman Weekend” consequences predicted by repo guru Zoltan Pozsar failed to materialize and central banks did not flood global markets with a torrent of liquidity, in a repeat of what happened in September 2008.

In his latest not published late on Friday, the Credit Suisse strategist admits that “Yes, we got central banks’ need to step in to calm funding market pressures this week wrong (still no need yet)” but he counters that “we got the direction of spreads right – on February 24th we warned about an imminent sentiment shift in funding markets. There was no premium last week but there is some funding premium now, and it feels that things can get worse still.” So net-net, he concludes, “our call was absolutely right.”

But how was he “absolutely right” if the funding squeeze he predicted did not materialize? Well, as Zoltan explains in the bulk of his note, what is happening right now is something that nobody really understands, and what is yet to happen may be a combination of the worst parts of the 2008, 2018 and 2020 crises, as a result of one thing: the collapse of commodity-based collateral (something China understands very well after it learned – on more than one occasion – that its thousands of tons of its commodity stockpile, especially copper and aluminum, had been rehypothecated, i.e., used as collateral repeatedly).

As the Hungarian writes, his point with the Lehman analogy last Sunday “was to underscore the point that just as the market didn’t realize the complexity and interconnectedness of the financial system then, it may not realize the same today. Again, we are not saying that we are about to have another Lehman moment, only that things can get much worse than you realize.”

Underscoring the unknown unknowns of a global sanctions blockade against Russia launched not by central bankers but by politicians, Zoltan writes that “when you rip $500 billion of FX reserves from the system, sanction and de-SWIFT banks (which goes live March 12th), and force Western banks and commodity traders to self-police and not trade commodities from the single-largest commodity producer of the world (Russia), unforeseen things can happen and do happen.”

He then writes something that all those pushing for an escalating conflict with Russia will hardly want to hear:

If you believe that the West can craft sanctions that maximize pain for Russia, while minimizing financial stability risks in the West, you could also believe in unicorns.

At this point the former NY Fed monetary plumbing expert pivots to what he failed to realize last weekend, and whose consequences will be more profound over the longer-term than a simple short-term plumbing block: “Yes we were also wrong on Sunday about the trigger of funding pressures – it’s not the Bank of Russia’s inability to roll FX swaps or de-SWIFTing that caused funding pressures to date, but rather the market’s self-imposed unwillingness to buy, move, or finance Russian commodities that’s driving the current massive bid for cash.”

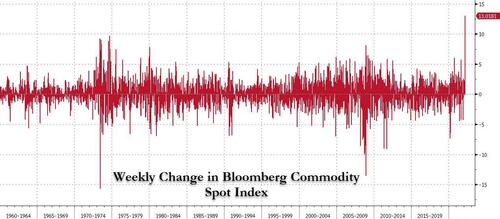

This translated into what Bloomberg called a “historic” commodities rally, manifesting itself in the biggest weekly increase in commodity prices on record…

… and so the margin calls must be historic too, according to Pozsar.

But who is getting the margin calls, the Credit Suisse strategist asks rhetorically, besides all those metals traders who got a barrage of “erroneous” margin calls last Wednesday and Thursday from the LME?

According to Pozsar, the answer is market participants that are long commodities either in the ground or in transit and want to lock in a price by shorting futures: “these include every commodity producer in the world including Russia, and every major commodity trading house, respectively.”

While it is unknown (for now) if that is indeed the case, Pozsar suggest that it’s reasonable to wonder “if Russian commodity producers are experiencing margin calls now, and if they have the resources to pay – could they choose not to pay because their sovereign’s FX reserves were seized?” This is one risk the Credit Suisse strategist says the market needs to carefully consider.

“As for the commodity traders, which are suffering a correlated surge in commodity prices (Russia and Ukraine export pretty much everything imaginable), margin calls can be funded by drawing on credit lines from banks, issuing CP, or swapping FX”, something that may already be happening as suggested by the sharp spike in the FRA-OIS funding stress indicator.

Here, instead of taking readers back to September 2008, Pozsar draws on one of the main lessons from the March 2020 liquidity crisis, which is that corporate credit lines (which have a low drawdown assumption according to Basel III) can be drawn across all industries and across all geographies at the same time in a pandemic, “and the lesson about the present crisis is that you can have a rally in all sorts of commodities from oil to gas, fertilizers, wheat, palladium, and neon during war, especially if the G7 force the world to self-police and boycott Russian stuff.”

Which takes us to the crux of today’s note: the role of commodities as collateral, which is critical because as Pozsar puts it, “every crisis occurs at the intersection of funding and collateral markets.”

Take Urals spot, which Zoltan writes “is trading at a discount to WTI is like subprime CDOs going from AAA to junk” and prompts him to ask if “all commodities sourced from Russia trade at a significant discount?” We put it somewhat differently last week, when we said that while Russian oil is trading bidless, non-Russian oil feels like it will soon go offerless.

Russian oil bidless, non-Russian oil offerless https://t.co/2n6o258AGE

— zerohedge (@zerohedge) March 3, 2022

Taking the analogy to CDOs further, Pozsar asks if it is possible that the Western boycott of Russian commodities is turning AAA commodities to junk (or bidless): “Does going from AAA to junk trigger margin calls? You bet!”

Besides collateral, the repo guru also reminds us that leverage and liquidity are also important, and takes us on a brief walk down the not too distant memory lane:

- In 1998, we had Russian bonds and a leveraged LTCM.

- In 2008, we had mortgages and leveraged banks and shadow banks.

- In March 2020, we had leveraged bond basis trades.

The pattern Pozsar points to is the following: “Collateral, leverage, funding” – in 1998 and 2008, collateral went bad and a funding crisis hit as a consequence. In 2020, corporations drew on credit lines, which sucked funding away from leveraged bond RV trades, which then triggered a forced sale of good collateral. As he summarizes it, “crises happen either because collateral goes bad or funding is pulled away – that’s been the central lesson in every crisis since 1998.”

Now on to today.

Pozsar points to Glencore’s iconic – if criminal – founder, whose Marc Rich’s legacy in the annals of global finance was to introduce the concept of leverage and borrowed money into commodity trading. It’s simple: a bank lends you the money to lease ships and buy commodities to deliver them sometime and someplace in the future at a locked-in price (via short futures).

The pattern should ring a bell.

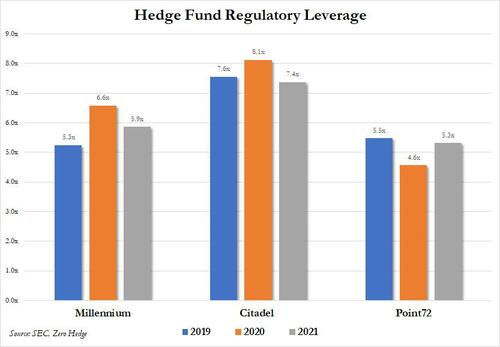

Consider your typical, highly levered bond RV fund, such as Millennium and Citadel, is long the bond, short the future, and funds the package in the repo market. It was this bond basis trade that was behind the repo market crash of 2019 and then blew up just a few months later in March 2020; it’s also why hedge funds with regulatory leverage as high as 8x were begging for a Fed bailout when their RV trades blew up, similar to what happened to LTCM in 1998.

That analogy, Pozsar argues, is the same as a commodity trader moving stuff around. But if collateral spoils, funding is impossible to come by and spot price spikes are triggering margin calls, or as he puts it “March 2020 all over again?” While it probably is not the same size, the repo guru advises readers to “be mindful of the parallels and the funding and collateral linkages.”

Which brings us to the punchline of Pozsar’s note:

We could be looking at the early stages of a classic liquidity crisis that has elements of both collateral and liquidity problems (1998 and 2008), where some players – commodity traders – are not regulated and have no HQLA, and some players – state-linked commodity producers – are not liquid enough because their backstop – the Bank of Russia’s FX reserves – has been seized.

The Hungarian then goes on a historical tangent looking at sudden stops in the financial system, or as we call them, repo breaks.

In 1997, we broke some FX pegs because FX reserves we thought were there weren’t, and capital stopped flowing in.

In the present context, we clearly are not worried about funding because “o/n RRP is at $1.5 trillion and banks have reserves coming out of their ears”.

We will note that it is rewarding to see that one of the biggest minds in finance agrees with what we have pointed out previously, namely that the blowout in the FRA-OIS when there is still $1.5 trillion in the overnight repo, is quite a remarkable achievement and suggests that not everything is as smooth as so many self-proclaimed Polyannish financial experts would lead you to believe. Furthermore, as Zoltan notes, “you should worry about a sudden stop of commodity flows for three potential reasons.”

- First, gas gets turned off “at the top”.

- Second, there is an accident – lots of pipes run through Ukraine and it’s a war.

- Third, sabotage in Ukraine to kick-start Nordstream 2.

Reverting again to his analogy on RV pair trades, Pozsar asks “what happens to the gas bit of the commodity derivatives market when there is a sudden stop of physical commodity flows, and what does that do to dealers’ matched books? There is the potential for some exposure there Will it happen? We don’t know, but again, the question itself is worth a spread.”

* * *

Summarizing his latest, mostly stream of consciousness note, Pozsar says that “we have bases creeping in and commodities, like collateral in 2008, are becoming bifurcated.” Meanwhile, spot prices are staging a historic and correlated surge that is driving demand for cash at a time of excessive leverage in the system both overt and covert – think “commodity RV trades” (as an analogue to bond RV trades) – and a lack of FX liquidity because of seized FX reserves.

Pozsar then gives one more thing to think about: “Is the reason why we’ve cocooned energy and other commodity flows and related payments and institutions from sanctions to protect the consumer at the pump, or to protect the commodity derivatives ecosystem? Clearly, the West does not want to turn off the flow of energy, but there are growing risks – more sanctions, more self-policing, and the Russian leadership can act as well.”

Having found himself in his prime, where he is connecting dots and observing causal linkages between his favorite financial topics and seemingly disparate corners of the financial system – in this case the commodity collateral sector – Pozsar is only just warming up, and next writes that “there are links between all this and headline inflation and interest rate hikes, and links between the seizure of Russia’s FX reserves and the dollar and demand for long-term Treasuries”, and asks readers to consider a quote from George Soros carved into the wall of the CEU (Central European University)…

“Thinking can never quite catch up with reality; reality is always richer than our comprehension. Reality has the power to surprise thinking, and thinking has the power to create reality. But we must remember the unintended consequences – the outcome always differs from expectations”.

… and to think about that both in the present context, and in the context of ABN Amro freezing redemptions from its funds in August of 2007 – a year before Lehman: did markets think it would get that bad back then?

Putting it all together, Pozsar writes that while this time systematically important banks won’t fail, some other traders might fold, and losses, even if not lethal, can curb balance sheet provision (see Archegos) for all other stuff that the buy side needs – repo, FX, and equity derivatives.

Pozsar concludes with another quote, this time from Larry Summers (from a speech he delivered in Toronto at an INET event about the lessons learned during the 2008 crisis):

“crises are not about estimating their economic impact and estimating to the decimal point the GDP impact of a shock. Crises are about fear and greed…”

Going back to the spark behind Pozsar’s latest stream of consciousness, commodity collateral, he writes that Russia and Ukraine are the single-largest commodity exporters in the world. And while Russia accounts for just 5% of the world’s GDP, it is financially deeply interlinked – it used to have $500 billion of FX reserves, and owes about as much in debt to the rest of the world, not to mention “off balance sheet” debt that it owes to the world through derivatives when spot commodity prices rally, like they do now.

His parting words are a warning to all those who think that it will be easy to sever all financial ties to Russia:

It’s a bit more complex to de-SWIFT Russia than it was to de-SWIFT Iran… To be clear – your correspondent is a funding expert, not a commodity expert, but I see a link between the two markets at the present, and parallels to 2008. I wasn’t an expert in CDOs in 2007 either, but started to dig the day after Paul McCulley coined the term “shadow banking” at Jackson Hole and I wrote this. My interest was piqued by the legendary Paul McCulley, and current events piqued my interest in the opaque world of the commodity derivatives complex.

The books about 1997, 1998, and 2008 have FX pegs, default and leverage, and collateral and leverage as their central themes, respectively. The books about today’s market events will have commodities as collateral as the central theme.

It’s this “commodity as collateral” theme that Pozsar believes will spark the next liquidity crisis.

Pozsar’s full note is available to pro subs in the usual place.

by Tyler Durden

Join: 👉 https://t.me/acnewspatriots

The opinions expressed by contributors and/or content partners are their own and do not necessarily reflect the views of AC.NEWS

Disclaimer: This article may contain statements that reflect the opinion of the author. The contents of this article are of sole responsibility of the author(s). AC.News will not be responsible for any inaccurate or incorrect statement in this article www.ac.news websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner. Reprinting this article: Non-commercial use OK. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

![Tucker Carlson Released an ALARMING Message … [Published Yesterday]](https://ac.news/wp-content/uploads/2024/04/download-3-120x86.jpg)

Discussion about this post