On the same day that Goldman’s chief of US equity research David Kostin capitulated for the second time in the past month, and one month after cutting his year-end S&P price target from 5,100 to 4,900, the Goldman strategist followed up with another 200-point cut to his S&P price target after the close on Friday (he now expects the S&P to close the year at 4,700, i.e., down on the year) but even so Kostin is trying to spin this latest deterioration as a positive outcome, saying it represents a generous 10% “upside” from current levels. There was no positive spin, however, in the far more downbeat thoughts that Goldman’s actual traders are sending out to their clients (trading desk research represents what Goldman actually believes, as opposed to the wholesale propaganda that emanates from sellside research).

So for an honest glimpse of how Goldman’s traders view what is the most unstable and chaotic market since March 2020, we excerpt from the latest note (available to pro subs in the usual place) written by Goldman’s head of hedge fund sales, Tony Pasqsuariello, who has aptly dubbed what is taking place a…

“paradigm shift.”

I’ve been banging away at this craft for 23 years, and the past few weeks rank right up there with some of the highest velocity periods for markets that I’ve ever seen.

There are no mysteries here: global growth was slowing … major policy shifts were underway … then the geopolitical variable exploded.

Given that setup, my risk framework starts with a concession to reality: the range of possible outcomes from here are exceptionally wide.

Said another way: market dynamics were becoming significantly more complicated — and, the degree of difficulty around money management was appreciably rising — for several months in advance of the Russia/Ukraine situation, and that mess has opened the door to a set of potential tail risks that most folks never had to contemplate.

So, amidst a period that’s featured epic volatility and risk transfer, my instinct is to approach the path ahead with a high degree of both humility and simplicity.

Therefore, what follows from here is a stripped-down take on the core issues of the day:

1. The week began with a one-day, $1tr loss of US equity market cap and a very serious amount of portfolio de-leveraging. the middle of the week was a textbook illustration of why timing from the short-side must be impeccable. This week we confronted another scorching CPI report (e.g. the highest m/m increase in primary rent since … 1987), a hawkish surprise from the ECB and ongoing headline ping-pong surrounding Eastern Europe. While that environment has generated some high quality, hyper-tactical opportunities along the way — arguably well captured by the macro community — it’s not for the faint of heart (and, it’s almost impossible to believe a not-so-distant year like 2017 saw a median daily market move of just 18bps, a max peak-to-trough drawdown of 2.8% and full-year realized volatility of 6%).

2. More broadly, and to borrow a thought experiment from a hot-handed client, consider this: in June of last year, just before Powell’s first pivot, S&P was trading around 4200. if you were told at that time … come March of 2022 … we’d be confronting $110 crude oil, 8% inflation and the invasion of a sovereign nation by a neighboring nuclear power … would you guess that S&P would still be trading around 4200 (or, that NDX would still be up 100% from the lows of March 2020)?

3. While you can poke holes in that approach — it ignores the rip higher that followed in H2’21, the S&P doesn’t represent the breadth of damage that’s actually taken place at the single stock level, look how crazy easy US real rates still are, on and on — the point is more that we’re confronting a set of issues that are far more complicated than what I’d instinctively associate with a multiple that’s still in the 87th percentile of market history. it’s also not what I would associate with the immediate removal of a G-20 economy from the global financial system.

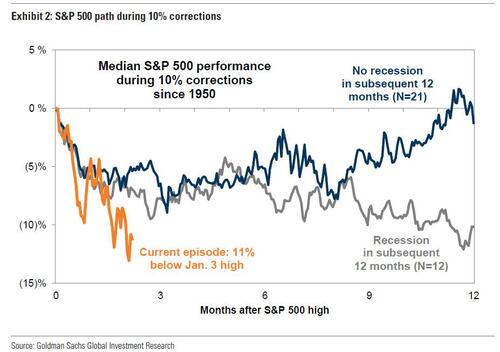

4. As noted before, the history of buying 10-20% drawdowns in the S&P when the economy is NOT headed towards a recession is very compelling.

That said, I find that I’m starting to worry more about the accumulation of downside risks to growth, which again I admit is more of an instinct than anything more sophisticated. in this regard, I think we should all be keeping a close eye on the funding markets — and, perhaps more importantly, the corporate credit markets — for signs that something more significant is manifesting.

5. Relative to most every other major equity market, S&P has seemingly benefited from “repatriation” and offered an element of safe haven status over the recent period. in the doing, one could argue we’re forcing more and more capital into a smaller set of the highest quality US names (the likes of MSFT and AAPL, and dare I say TSCO and DLTR). while I sincerely believe those are the right places to allocate your equity capital, for the avoidance of doubt, the ante has been upped — so, for the index to be ok, those names really, really need to hold the line.

6. If you take a really big step back, one can argue the past few weeks have poured kerosene on a tectonic shift that’s taken shape over the past six years: a push away from globalization and towards regionalization. in essence, we’re witnessing an inflection that is the photographic negative of the period that spanned from the fall of the Berlin Wall in 1989 to the Brexit vote in 2016. far be it from this English major to go too far with this line of deep thinking, but I think the trend is clear for all to see now … it has only been amplified by the East/West geopolitical tension … and, it marks a paradigm shift from the world I came up in.

7. Some superficial market thoughts follow from there, throw tomatoes at me if you wish:

- it argues for the increased consumption of commodities and affirms the underlying super cycle, link;

- it argues for a major retooling of the West’s power and defense complexes;

- it ultimately argues for more spending on alternative energy, while probably later in the sequence;

- it seems to strongly very argue for more inflation, higher wages and less corporate efficiency;

- it argues for more investment in technology, but in a two-sphere sense;

- from a growth and capital markets perspective, it argues for North America as it argues against China;

- more broadly, it argues for a schism between DM and EM markets. on that last point, in the context of the UN General Assembly Resolution censoring of Russia, of the five BRICS countries, just one voted for it (Brazil) … three abstained … and (obviously) one voted against.

8. If this argument for regionalization is more or less directionally correct, it likely involves some hard truths — some basic cause-and-effect — for financial market participants: more fragility, more volatility, less liquidity. I don’t think it’s an “all-bad” scenario, however, and the investing implications are immense. while some of these recalibrations are clearly underway (witness price action HSCEI, which is back towards to lows of Lehman), I have to think this is a theme that’s here to stay. and, I think it’s ultimately highly accretive to active managers and stock selection.

9. Much more locally — and, at the risk of sounding too-clever-by-half — I’m still of the view that S&P is range-bound with ongoing downside asymmetry. therefore, I’d stick with the goal posts of buying below 4200 and selling over 4500. next week is a huge one, featuring the FOMC on Wednesday and a major derivatives expiry on Friday (as ever, I’m respectful of quarterly expiries as markers of inflection points). along the way, I tend to think the market goes into the next phase of the game with a very de-risked and de-levered trading community (the past week has seen immense volume and risk transfer, note GSTHHVIP now down 20% since November), while also featuring a retail investor who is full of risk and likely confronting a large capital gains tax bill next month. where I’m going with this: the market is susceptible to more short-cycle squeezes, while the broader cut of positioning is still too long … and, I worry my 4200/4500 tactical framework may be obscuring the bigger stories.

10. You don’t need me to tell you that the past few weeks have featured a set of extraordinary rallies in the commodities space. More broadly, on a 2-month lookback, we’ve just witnessed the biggest rally in commodity indices since … the 1970s. I mention this not because I’d expect those moves to necessarily extend in the short-term. I say it because when you sit around the dinner table with a set of very senior risk takers, it’s hard NOT to conclude that most everything still points in the direction of a world that will be very, very commodity intensive. Even though last week’s statement on the relatively tiny size of commodities relative to both Equities and Fixed Income resulted in some spicy Twitter comments (“Nobel Prize material type of analysis, Tony”), I stand by the claim and think it’s inherently very bullish for the space.

11. I don’t know what to think of European equities right now, other than to say that my year-end optimism was perhaps the worst idea since Robin Ventura charged Nolan Ryan. To be clear, the recent period has featured some of the worst underperformance of SX5E relative to S&P in the post-GFC period — that’s saying something — and it’s hard to see how the European industrial sector doesn’t suffer. that said, if stocks are to live in the future, one can see a path to major fiscal expansion — and, more elementally, a much strong European Union (emphasis on Union). which segues to this …

12. Mark Wilson, GMD: “for the second time in as many years, Europe experienced its ‘Hamilton moment.’ ever since its founding, the fractured politics of the European ‘Union’ have been all too evident, perhaps best illustrated in numerous episodes of the last decade as the uneven financial consequences of the GFC roiled a still adolescent political construct. yet, the unified strength of purpose shown by the European alliance in response to recent events is mightily impressive — this time led by Germany, as she showed willingness to subjugate the gigantic cost of an increasingly expensive commodity burden to the broader political will of her allies. Merkel’s recent departure may have emboldened Putin’s resolve to take his chosen course, given the presence of newer and (perceived) untested European leadership; yet, Germany’s metamorphic developments in response to this crisis have been dramatic: Schulz has overseen 3 seismic policy initiatives in shockingly short order –

- a historic expansion in re-armament spend,

- the cancelled certification of NordStream 2, and

- a radical new energy plan aimed at cutting dependence on Russian gas [this is even more radical when you consider this government includes the world’s strongest Green Party representation].

Ultimately, the unanimity & assumed political influence of the European Union has come of age in the last 2 weeks.”

13. worth clicking on:

- i. sticking with the focus on the low-end consumer :: link.

- ii. the economic impact of cyber, a theme that must only be gaining steam :: link.

- iii. America the generous: link.

- iv. no meetings before 11:00 am: link.

14. a chart of US financial conditions … as I see it, clearly tightening, but still quite loose over the longer history:

15. and, now a chart of global financial conditions … note the past month has seen the greatest rate-of-change since the GFC:

16. a basket of stocks leveraged to US growth … vs those leveraged to non-US growth … following from the prior points, you can probably guess where I’m going with this:

17. a GS custom basket of stocks with large buybacks vs the market. Given this chart, it’s perhaps no surprise that Goldman research expects $1tr of actual repurchase in 2022 (link):

18. this is not a comforting chart … the UN index of world food and agricultural prices:

by Tyler Durden

Join: 👉 https://t.me/acnewspatriots

The opinions expressed by contributors and/or content partners are their own and do not necessarily reflect the views of AC.NEWS

Disclaimer: This article may contain statements that reflect the opinion of the author. The contents of this article are of sole responsibility of the author(s). AC.News will not be responsible for any inaccurate or incorrect statement in this article www.ac.news websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner. Reprinting this article: Non-commercial use OK. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

![Tucker Carlson Released an ALARMING Message … [Published Yesterday]](https://ac.news/wp-content/uploads/2024/04/download-3-120x86.jpg)

![BENJAMIN FULFORD GEOPOLITICAL UPDATE 4⧸1⧸24…AUDIO READING [mirrored]](https://ac.news/wp-content/uploads/2024/04/download-16-120x86.jpeg)

Discussion about this post